Discover your Competitors

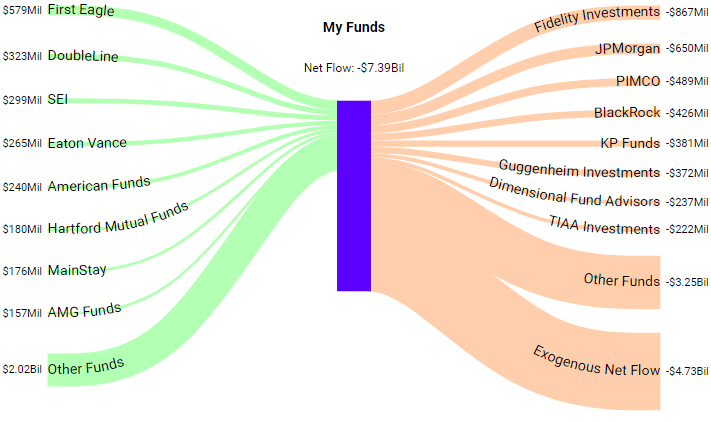

If you think you're just competing with funds within your category, you're missing a lot. Flowspring identifies your competitors as the funds that you are winning or losing the most assets from - this can include funds outside your category entirely.

Furthermore the magnitude with which you compete with other firms can be staggeringly uneven, leading to excellent opportunities to focus your efforts on individual fund-to-fund comparisons your investors are making.

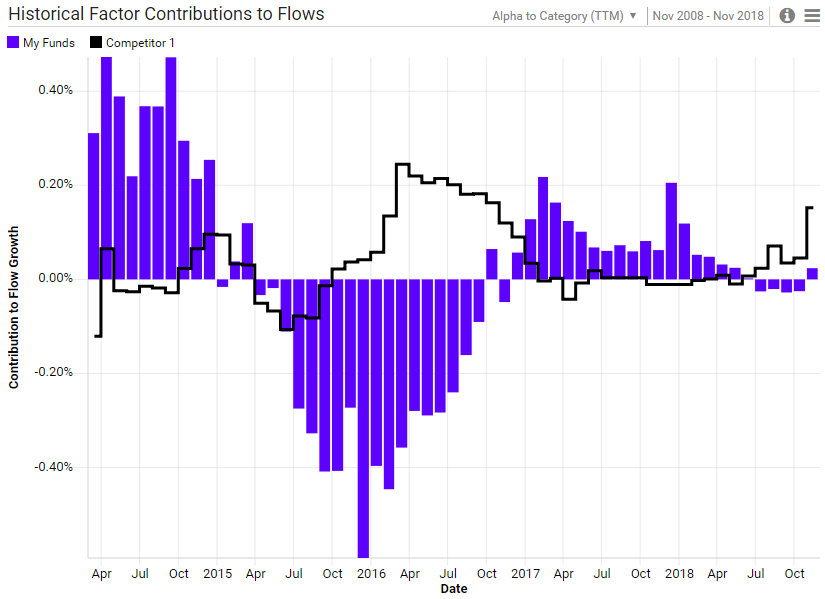

Understand why you're growing at a different rate than your competitors

Products and investor preferences for those products are constantly changing. Flowspring's factor model of fund flows can disentangle the effects of fees, investment performance, category preferences, and dozens more factors that drive organic growth rates. We make it easy to identify why you are winning or losing to a given competitor.

Take action to stem outflows and magnify inflows

Once you've identified your key competitors and why they're winning or losing assets to you, formulate a plan to maximize inflows and minimize outflows. This could involve new marketing collateral, sales incentives, a new fee structure, or even production rationalization.